Condo Insurance in and around Lawrenceville

Get your Lawrenceville condo insured right here!

Protect your condo the smart way

Home Is Where Your Heart Is

Because your home is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to fire or weight of sleet. That's why State Farm offers coverage options that may be able to help protect your most personal possessions.

Get your Lawrenceville condo insured right here!

Protect your condo the smart way

Condo Coverage Options To Fit Your Needs

Despite the possibility of the unpredictable, the future looks bright when you have the excellent coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your townhome and personal property inside, you'll also want to check out liability coverage bundling, and more! Agent Nicole Billings-Turner can help you generate a plan based on your needs.

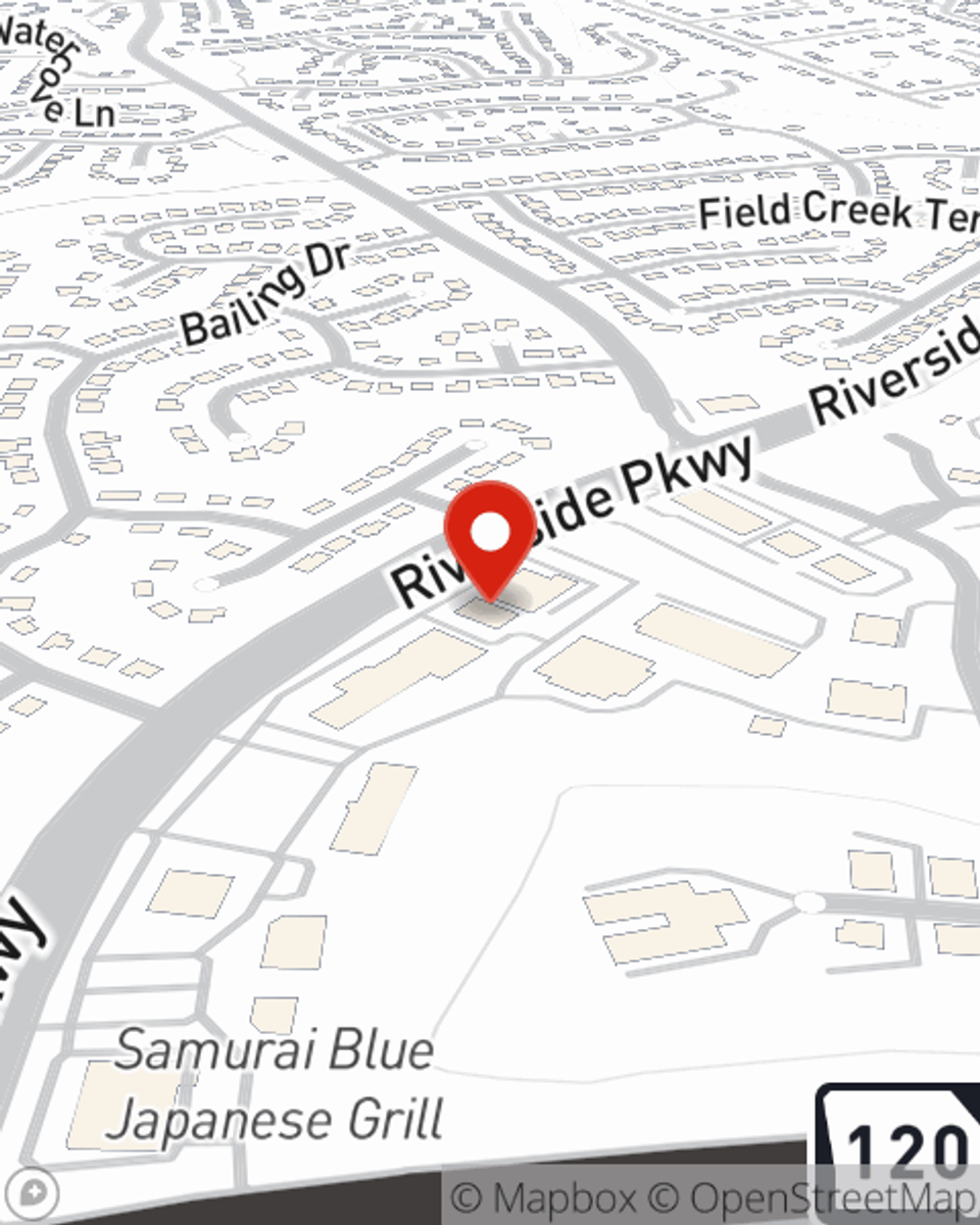

Visit State Farm Agent Nicole Billings-Turner today to see how one of the well known names for condo unitowners insurance can help protect your townhome here in Lawrenceville, GA.

Have More Questions About Condo Unitowners Insurance?

Call Nicole at (770) 448-5100 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Nicole Billings-Turner

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.